WAIT! Before you buy C3.ai $AI....

The entire AI industry is printing money, but why has $AI's stock only fallen?

Highlights:

C3.ai is a Republican Party-linked firm with strong institutional and political support. It would likely benefit tremendously from a Trump election.

It has strong AI CRM platforms that compete with Palantir and Databricks. C3.ai is ahead of its competition in these fields.

C3’s founder, Tom Siebel, is a dot-com bubble veteran who navigated his former company, Siebel Systems, to a buyout by Oracle.

In the best-case scenario, investors can expect approximately a 5x return, with STRONG caveats.

There are many skeletons in the closet. A look at C3’s cash flows and income statement is terrifying.

Stock information:

Stock name: C3.ai, Inc.

Ticker: AI

Market Cap: $3.38 Billion

HQ location: 1400 Seaport Blvd

Redwood City, California 94063

United States

Performance since inception: -33.74%

Company overview:

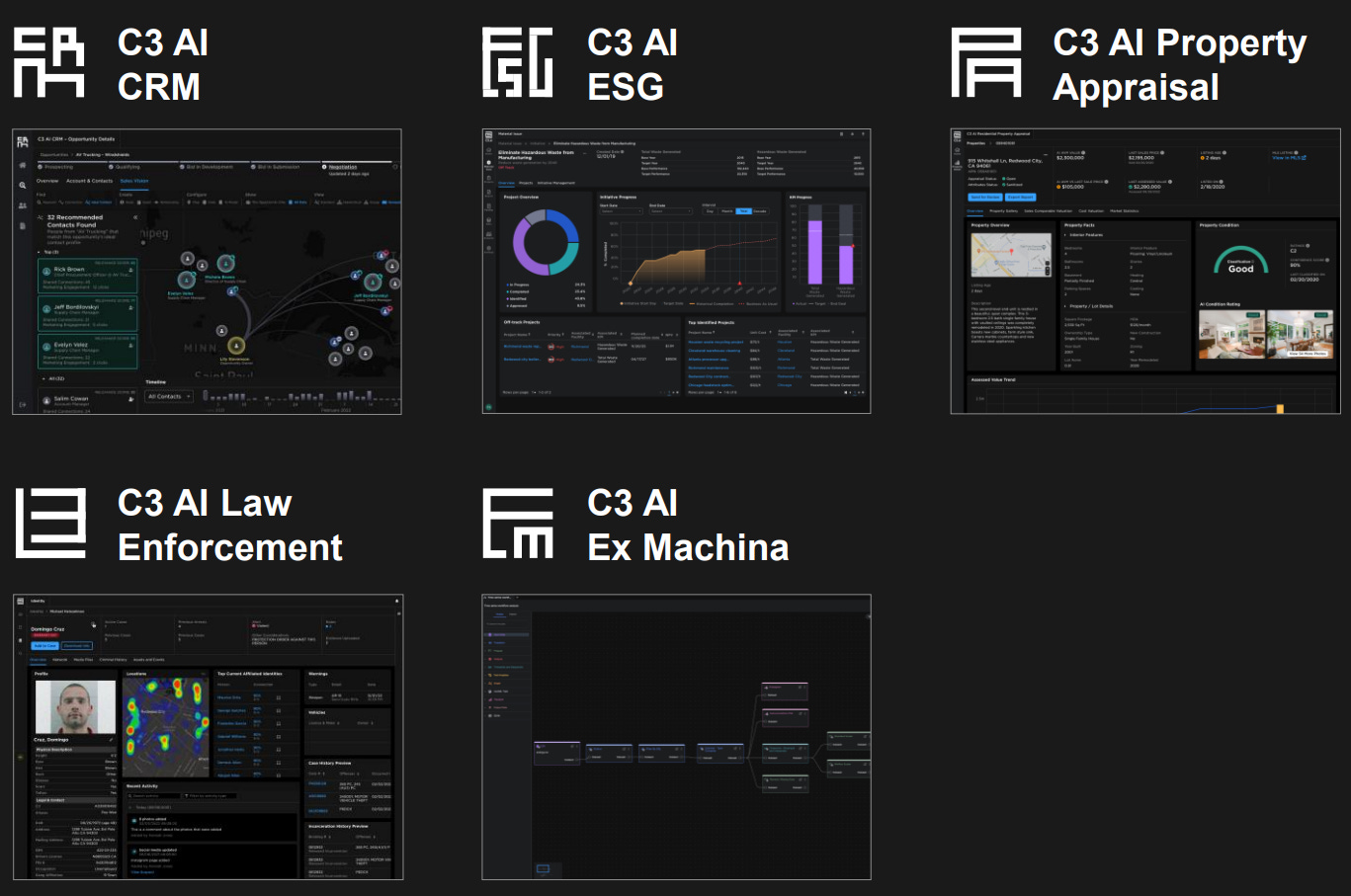

The company provides C3 AI platform, an application development and runtime environment that enables customers to design, develop, and deploy enterprise AI applications; C3 AI CRM Suite, an industry specific customer relationship management solution; and C3 Generative AI that enables to locate, retrieve, present information, disparate data stores, applications, and enterprise information systems.

Market Opportunity:

Business Model:

C3.AI is like an AI add-on to a business that helps you gradually adopt AI/ML. Currently you can NOT run your whole business on C3.AI. The closest company you could compare C3.ai to is Palantir. Palantir is like a data integration and development hub upon your existing business. It helps you gradually adopt a data-centric way to run your whole business. You can run your whole business on Palantir optionally and preferably backed by your existing systems. And AI/ML is just one add-on for a long time to Palantir’s platform. It is widely said Palantir is more end-to-end or full-stack.

You can compare the two to operating systems. I’d say if C3.AI is like an AI operating system (AI model centric), then Palantir is more like a data operating system.

Notable Investors:

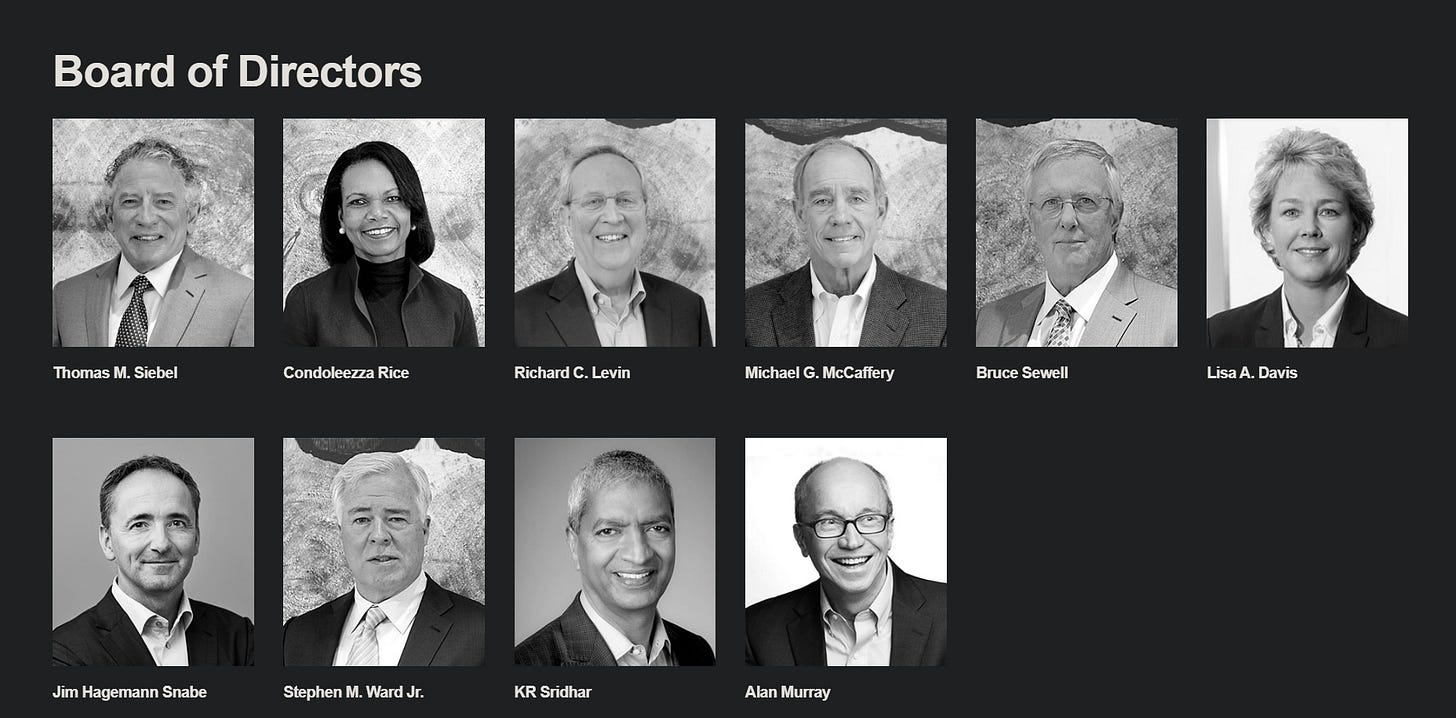

I think the most recognizable face on this board of directors is Condoleezza Rice. She served as the 66th United States secretary of state from 2005 to 2009 and as the 19th U.S. national security advisor from 2001 to 2005.

Other highlights include:

Dr. Levin who was the president of Stanford University and former CEO of coursera.

Michael McCaffery is a former member of the Nvidia board of directors.

Bruce Sewell, former general counsel of Apple Corporation.

There is a decent bench of tech and government talent here, but it’s important to remember that the role of a company's board of directors is advisory at best. At worst, many end up on a board of directors as a sinecure, merely collecting fees for low effort during the twilight years of their careers.

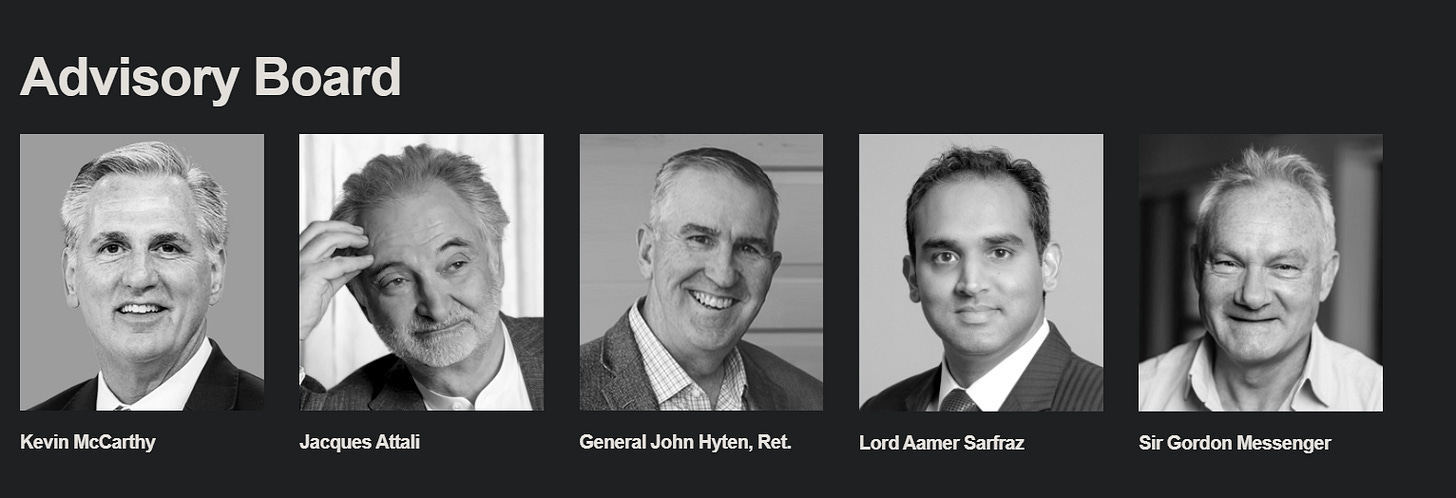

The most notable name here is Kevin McCarthy, who is the 55th Speaker of the United States House of Representatives. I notice that among Condoleezza Rice and McCarthy, the political figures here are exclusively members of the Republican Party. The good news is that if Trump wins the election, the spoils for firms linked to the Republican Party are only going to increase. That’s likely good for C3.ai. As of writing, President Biden has announced he will not seek re-election, and the odds are pointing towards a Trump victory in 2024.

Top Institutional Holders:

Keep reading with a 7-day free trial

Subscribe to Investing with Eugene to keep reading this post and get 7 days of free access to the full post archives.